What Is The Eitc For 2025. In 2025, the maximum eitc amount will be $8,046 for qualifying taxpayers with three or more eligible children. For taxpayers with three or more qualifying children, the maximum eitc amount for 2025 is $8,046, an increase from $7,830 in 2025.

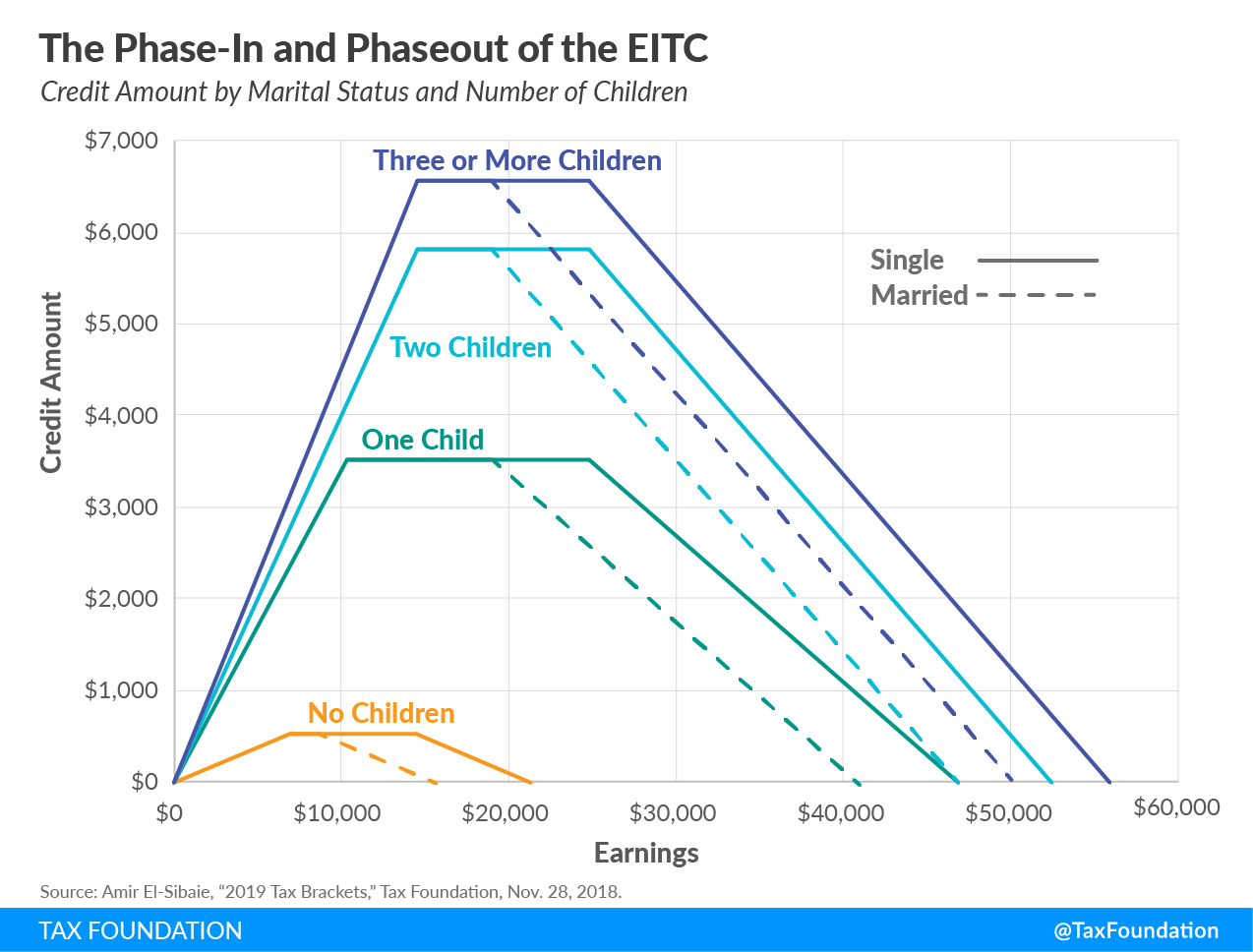

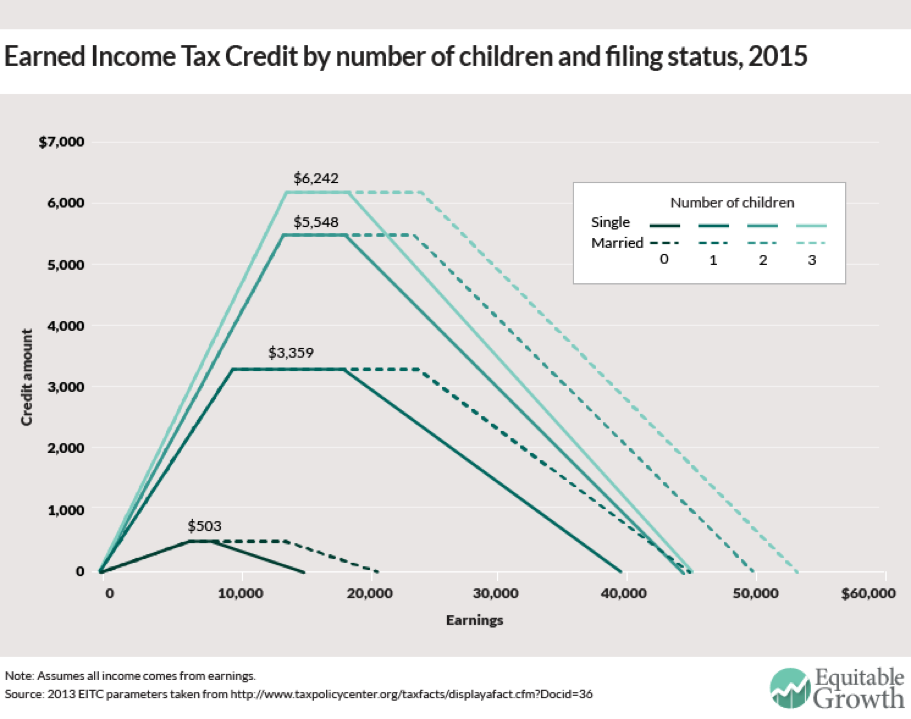

The earned income tax credit is a refundable tax credit that is available for people with an earned income below a certain threshold. The irs has detailed schedules for disbursement, with direct.

2025 Eitc Limits Max Arluene, For 2025, the maximum earned income tax credit (eitc) amount available is $8,046 for married taxpayers filing jointly who have three or more qualifying children—it was.

2025 Eitc Limits Max Arluene, To qualify for the eitc in 2025, taxpayers must meet these core requirements:

How Much Is The Eitc For 2025 Cristy Melicent, $7,152 (up from $6,960) for two qualifying children;

Eitc 2025 Nelli Libbie, For taxpayers with three or more qualifying children, the maximum eitc amount for 2025 is $8,046, an increase from $7,830 in 2025.

Eitc Awareness Day 2025 Junie Melissa, For 2025, the maximum earned income tax credit (eitc) amount available is $8,046 for married taxpayers filing jointly who have three or more qualifying children—it was.